Quantifying Antitrust Damages: Market Structure Based Approaches and Industrial Organization Models

A particularly sophisticated method for quantifying antitrust damages leverages Industrial Organization (IO) models that analyze the structure and behavior of markets to provide a rigorous framework for estimating how competition distortions affect market outcomes.

Quantifying antitrust damages is a meticulous task that blends economic theory with real-world evidence to measure the impact of anti-competitive conduct. We discussed a highly summarized overview of the various considerations in estimating antitrust damages in our article on Overview of Antitrust Damages Estimation. We specifically talked about Comparator based methods and Financial analysis-based techniques in our previous articles, and now we will talk about quantitative analysis for antitrust damages using a market structure based approach.

A particularly sophisticated method leverages Industrial Organization (IO) models that analyze the structure and behavior of markets to provide a rigorous framework for estimating how competition distortions affect market outcomes. These models provide a detailed and structured method for estimating the economic harm caused by anti-competitive conduct, leveraging theoretical precision and empirical data.

What Are Industrial Organization Models?

Industrial Organization (IO) models serve as theoretical frameworks to analyze how firms compete within a market and how these dynamics change under various conditions. These models emphasize the strategic interactions between firms—whether through pricing, output, or market entry decisions—and their effects on consumers and market outcomes.

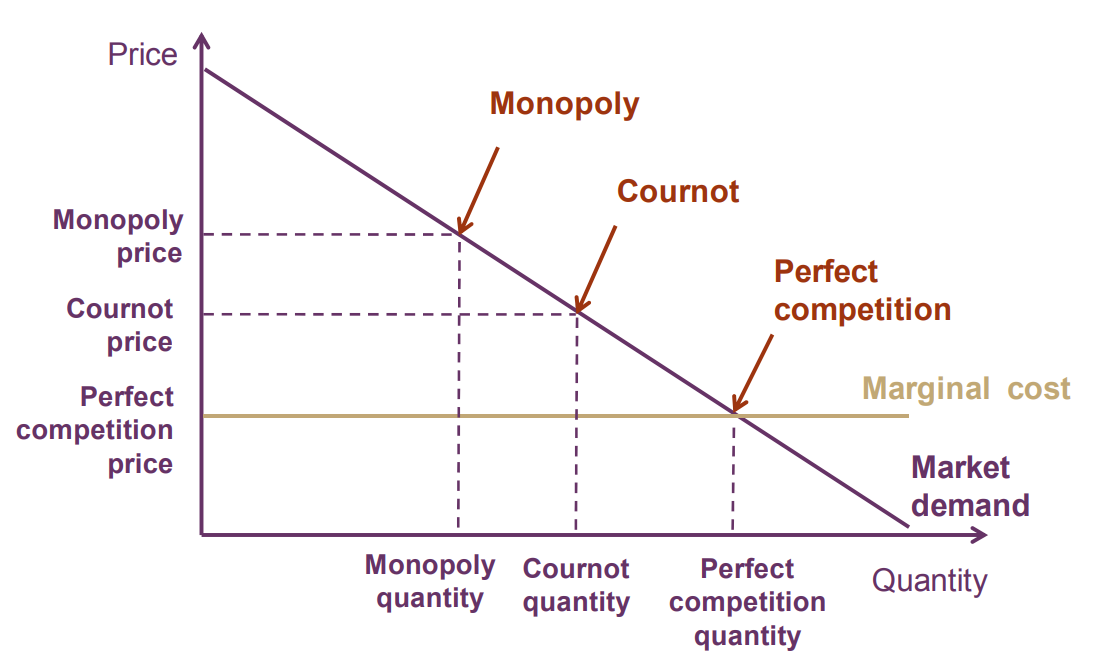

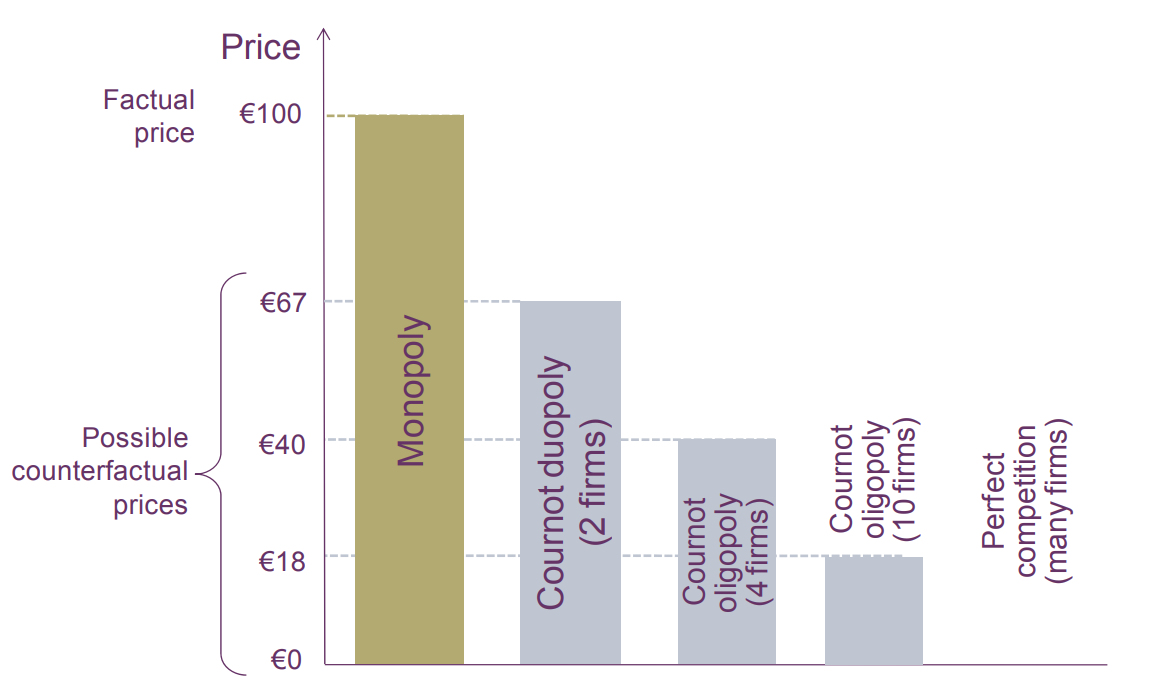

By simulating competitive and anti-competitive scenarios, IO models allow analysts to assess how conduct such as collusion, abuse of dominance, or exclusionary practices distort prices, quantities, and consumer welfare. They are particularly valuable in antitrust cases because they offer a counterfactual analysis: a simulation of what the market would have looked like in the absence of anti-competitive behavior.

Several types of IO models are commonly used in damages estimation, each tailored to specific market characteristics and dynamics.

1. Cournot Competition: Quantity as the Battleground

The Cournot model is a foundational IO framework where firms compete by choosing the quantities of their goods to produce. In this model, firms recognize that their output decisions influence market prices, leading to strategic interactions. Each firm aims to maximize its profit while anticipating the production decisions of its competitors. The resulting equilibrium reflects a balance where no firm can unilaterally improve its outcome.

This model is particularly suited for industries with capacity constraints or production planning requirements, such as manufacturing or energy markets. In an antitrust context, the Cournot framework can help evaluate how mergers or cartels influence total market output and prices. For instance, in cases where collusion reduces the number of active competitors, the model predicts reduced output and higher prices, allowing analysts to estimate the resulting consumer harm.

2. Bertrand Competition: The Price Wars

Unlike Cournot, the Bertrand model assumes that firms compete primarily on price rather than quantity. This model is based on the principle that in markets with homogeneous products, firms will continue to undercut each other’s prices until they reach the marginal cost of production. The result is an intensely competitive environment that maximizes consumer surplus.

Bertrand models are particularly useful in analyzing price-fixing cases. For example, in a cartel where firms agree to maintain prices above competitive levels, the Bertrand model can simulate the prices that would have prevailed in a competitive market. By comparing these simulated prices with the observed prices, the model helps estimate the extent of overcharges and the associated damages.

3. Differentiated Bertrand Competition: Accounting for Unique Products

In many real-world markets, products are not perfectly interchangeable. The differentiated Bertrand model extends the standard Bertrand framework by incorporating product differentiation. Firms may compete on attributes like quality, brand, or unique features, which gives them pricing power even in competitive markets.

This model is particularly relevant for industries such as pharmaceuticals, consumer electronics, or luxury goods, where differentiation drives consumer choices. Analysts use this framework to study how anti-competitive practices, like exclusive agreements or predatory pricing, exploit product differentiation to harm consumers. For instance, a dominant firm might leverage its unique product attributes to set excessively high prices, and the model can estimate how competition would have limited such behavior.

4. Stackelberg Competition: Leadership in the Market

The Stackelberg model introduces a dynamic where one firm, the leader, sets its output or price first, and the followers respond accordingly. This model reflects real-world scenarios where dominant firms influence market outcomes through their strategic actions.

In antitrust investigations, the Stackelberg framework can analyze cases of abuse of dominance. For instance, a leading firm might deliberately limit its output to raise prices or impose market conditions that disadvantage smaller competitors. The model can simulate alternative market outcomes, helping to estimate both immediate and long-term damages.

Selecting the Most Suitable IO Model

The choice of an IO model is a critical step in damages estimation. Different models are suited to different market settings, and the selection depends on the characteristics of the industry and the nature of the anti-competitive conduct.

For instance, industries where firms compete primarily on price may be better analyzed using Bertrand models, while those with quantity-based competition may favor Cournot models. Similarly, in markets with differentiated products, more nuanced frameworks like the differentiated Bertrand model may be appropriate. The availability of data also plays a significant role. High-quality data on costs, prices, and market shares enable the application of more sophisticated models, while limited data may necessitate simpler approaches.

A well-suited model not only captures the specific dynamics of the market but also ensures robust results that can withstand scrutiny in legal or regulatory settings. This makes the process of selecting an IO model both technical and strategic.

Using IO Models in Damages Estimation

IO models are applied to antitrust damages estimation using one of two main approaches: the one-model approach or the two-model approach. Each has its strengths and is chosen based on the complexity of the case and the available data.

The One-Model Approach

The one-model approach relies on a single IO model to simulate both the actual market (post-infringement) and the counterfactual market (competitive scenario). For example, an analyst might use a Bertrand model to estimate what prices would have been in the absence of collusion. The observed prices during the infringement are compared to these simulated competitive prices to estimate overcharges.

This approach is efficient and straightforward but assumes that the chosen model accurately captures both the competitive and anti-competitive market conditions. Its simplicity makes it suitable for cases with well-defined and stable market dynamics.

The Two-Model Approach

The two-model approach, by contrast, uses different models to simulate the actual and counterfactual markets. For instance, the actual market may be modeled using a framework that incorporates the specifics of the anti-competitive behavior, such as collusion. The counterfactual, on the other hand, might employ a model based on competitive assumptions, like Bertrand or Cournot competition.

This method allows for greater flexibility and precision, as it can accommodate significant differences between the competitive and anti-competitive scenarios. However, it requires more data and is computationally intensive, making it better suited for complex cases involving dynamic or highly differentiated markets.

Real-World Applications and Insights

The application of IO models to damages estimation has been pivotal in high-profile antitrust cases. In cartel cases, models like the Bertrand framework have been used to simulate the competitive prices that would have prevailed without collusion. Similarly, in abuse of dominance cases, IO models help quantify the exclusionary effects of anti-competitive practices on prices and output.

A notable example involves merger analysis, where IO models are employed to predict the post-merger pricing behavior of firms. By simulating how increased concentration impacts market power, these models inform regulatory decisions on whether to block or approve mergers.

Challenges and Considerations

While IO models provide a robust analytical foundation, their accuracy depends on the quality of inputs and the appropriateness of assumptions. Data limitations, such as incomplete cost or pricing information, can hinder the reliability of results. Furthermore, the choice of model parameters, like demand elasticity, often involves a degree of estimation, introducing potential sources of error.

Despite these challenges, IO models remain a cornerstone of modern antitrust analysis, offering a transparent and theoretically grounded approach to quantifying damages.

Industrial Organization models are powerful tools for understanding and quantifying the impact of anti-competitive behavior. By modeling firm interactions and market dynamics, they provide a rigorous basis for estimating damages in antitrust cases. Whether using a one-model or two-model approach, these frameworks enable analysts to create credible counterfactual scenarios that illuminate the true cost of competition distortions. As antitrust enforcement grows more data-driven, IO models will continue to play a central role in ensuring markets remain fair and efficient.