Damages Estimation in Antitrust: An overview

The process of quantifying damages is both complex and crucial, and among other qualitative considerations it also involves estimating the economic harm suffered, which often requires sophisticated economic modeling and expert analysis.

Damages estimation in antitrust claims plays a critical role in enforcing competition laws, particularly in the United States, where antitrust litigation is a key tool for protecting market integrity. Under U.S. antitrust law, claimants—whether private parties or government agencies—seek compensation for injuries caused by anticompetitive practices, such as price-fixing, monopolization, or collusion. The process of quantifying damages is both complex and crucial, and among other qualitative considerations it also involves estimating the economic harm suffered, which often requires sophisticated economic modeling and expert analysis. While the U.S. is known for its vigorous enforcement and significant monetary awards in antitrust cases, other jurisdictions, including the European Union, Canada, and Australia, have also developed robust frameworks for damages estimation, though with varying legal standards and methodologies. We will discuss these further with specific focus on The United States.

Stages in Damages Estimation

Stage 1: Determining the Counterfactual (‘But For’) Scenario

The first stage in estimating damages in antitrust claims usually involves constructing a counterfactual scenario that represents the competitive conditions that would have existed "but for", or without the presence of, the anticompetitive conduct in question. This requires identifying the type of competition law infringement that has caused harm, such as cartel price-fixing, monopolistic exclusionary practices, or abuse of dominance. The nature of the infringement determines the extent and scope of the damage. For example, in cartel cases, the harm typically arises from inflated prices, whereas exclusionary practices may reduce consumer choice or impede market access for competitors. Additionally, it is crucial to consider who has been harmed, which can include direct purchasers (those who buy directly from the infringing entity) or indirect purchasers further down the supply chain. The market context also plays a pivotal role: damage calculations may differ significantly between a mature market with stable pricing histories and a rapidly evolving or nascent industry where competitive dynamics are less predictable.

Stage 2: Calculation from Factual/Counterfactual to Final Damages Value

Once the counterfactual scenario is established, the next step involves quantifying the difference between the actual and hypothetical competitive market conditions to determine the final damages value. This typically includes calculating the annual overcharge during the period affected by the infringement (often referred to as the "class period") and may also involve estimating the impact beyond the cessation of the anticompetitive conduct, as damages can continue to accrue. Analysts must differentiate between accounting cash flows and economic cash flows, ensuring adjustments for non-cash items that do not reflect true economic harm. The time value of money is another critical factor, where damages are adjusted to reflect the cost of capital or foregone interest, making the award more representative of the economic loss. Jurisdictions differ significantly in their legal approaches to awarding interest; some may include compound interest, while others allow only simple interest, which can substantially affect the total damages awarded. In fact, this variation highlights the extreme importance of jurisdiction-specific expertise in accurately estimating antitrust damages.

The Counterfactual Stage: What type of Infringement cases what type of harm?

Hardcore Horizontal Price-Fixing and Market-Sharing Cartels

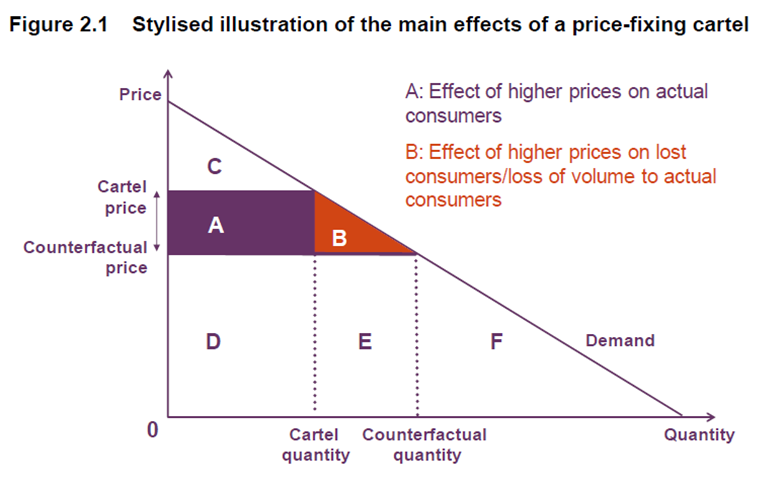

Horizontal agreements among competitors, such as price-fixing and market-sharing cartels, are considered some of the most severe antitrust infringements due to their direct impact on competition. The harm caused by these practices often manifests as a cartel overcharge, where consumers or downstream businesses are forced to pay prices significantly above the competitive level. Additionally, there can be a lost-volume effect, where artificially high prices reduce overall demand, leading to lower sales volumes and reduced market efficiency. In cases of quantity fixing, customer allocation, or bid-rigging, the damage goes beyond just overcharges; these practices limit market choices, stifle innovation, and prevent competitive bidding, thereby depriving purchasers of the benefits of a truly competitive market. Quantifying the harm requires establishing a counterfactual price level and volume of sales that would have existed without the cartel’s collusion, which can be particularly challenging in industries with significant price volatility or complex cost structures.

Exploitative Abuses of Dominance

Exploitative abuses typically involve a dominant firm leveraging its significant market power to restrict output or engage in excessive pricing. Although these cases are less common than exclusionary abuses, they can cause substantial economic harm, particularly in markets with few competitors or high barriers to entry. The most prevalent form of exploitative abuse is excessive pricing, where a monopoly charges prices far above competitive levels, extracting undue profits from consumers. However, constructing a counterfactual in these cases can be difficult because there may not be clear benchmarks or comparable firms to estimate what prices would have been under competitive conditions. When a monopoly has entrenched itself through significant barriers to entry, such as regulatory protections or control over critical resources, the counterfactual scenario cannot simply assume the existence of a fully competitive market, necessitating more nuanced modeling approaches that take into account the unique market structure and potential for theoretical or hypothetical competition.

Exclusionary Abuses of Dominance and Vertical/Horizontal Agreements with Exclusionary Effects

Exclusionary practices, whether by dominant firms or through restrictive agreements, prevent or limit competition by hindering the ability of rivals to compete effectively. Such practices include exclusive dealing, tying and bundling, predatory pricing, refusal to supply, and margin squeezing. These actions can harm competitors, drive up costs, or restrict market access, ultimately leading to reduced consumer choice and innovation. The counterfactual analysis in these cases requires determining how the market would have evolved had these exclusionary tactics not been employed. For instance, a dominant firm that engages in selective distribution or exclusive supply agreements may foreclose access to crucial distribution channels or essential inputs, thereby preventing new entrants from gaining a foothold. The complexity here lies in modeling the competitive landscape that would have existed in the absence of these exclusionary practices, taking into account factors like market growth rates, potential new entrants, and consumer switching behavior.

Methods for Estimation of Damages

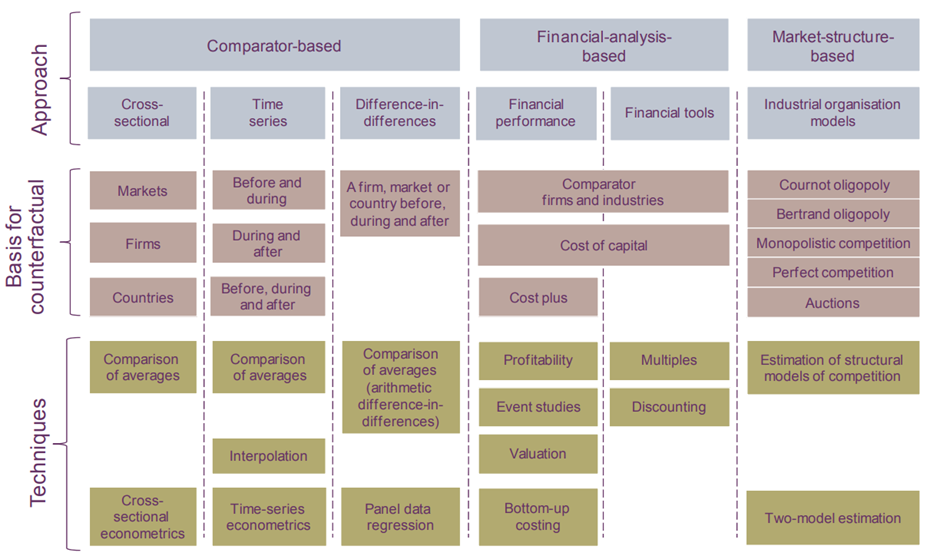

Over time, numerous models have been developed to estimate antitrust damages, each tailored to address the complexities of different types of infringements and market conditions. The aim of this overview is to introduce some of the most widely used approaches, providing a foundation for understanding how they can be applied to various antitrust cases. These models range from simple, direct comparison methods to more sophisticated econometric and simulation techniques, each varying in their requirements and level of precision. In subsequent articles, we will delve deeper into the specific methodologies, exploring their advantages, limitations, and practical applications. Below we give an illustration of the most popular models:

The selection of an appropriate model for estimating damages largely depends on the availability and quality of data, as well as the robustness of the counterfactual scenario that can be established. For instance, certain models may rely heavily on having access to high-quality cross-sectional data from similar markets as a basis for comparison. In other cases, historical data may be used to model pre- and post-infringement periods to establish the but-for scenario. When such data is limited or unreliable, more complex models requiring assumptions and approximations may be necessary, adding layers of uncertainty to the damages estimation process.

We will discuss the most important of these methods in subsequent articles. Until then, happy learning!